The Greatest Guide To Personal Loans Canada

The Greatest Guide To Personal Loans Canada

Blog Article

The smart Trick of Personal Loans Canada That Nobody is Talking About

Table of ContentsSome Ideas on Personal Loans Canada You Need To KnowSome Known Details About Personal Loans Canada The smart Trick of Personal Loans Canada That Nobody is DiscussingWhat Does Personal Loans Canada Mean?Getting My Personal Loans Canada To Work

Payment terms at most individual loan lenders vary in between one and seven years. You receive every one of the funds simultaneously and can utilize them for almost any function. Consumers usually use them to finance a possession, such as an automobile or a boat, repay debt or aid cover the cost of a significant expenditure, like a wedding celebration or a home restoration.:max_bytes(150000):strip_icc()/Pay-Day-Loan-Personal-Loan-dfdeaa22f6ea4790b1c966fcd6c937cf.jpg)

A set price offers you the security of a predictable month-to-month settlement, making it a preferred selection for consolidating variable rate debt cards. Payment timelines vary for individual financings, yet consumers are often able to pick settlement terms in between one and 7 years.

The Buzz on Personal Loans Canada

The cost is usually subtracted from your funds when you settle your application, minimizing the quantity of money you pocket. Individual fundings rates are much more directly linked to short term rates like the prime rate.

You may be supplied a lower APR for a shorter term, because loan providers understand your equilibrium will certainly be paid off quicker. They might charge a higher rate for longer terms knowing the longer you have a car loan, the most likely something might transform in your funds that could make the settlement unaffordable.

An individual funding is likewise a good alternative to using charge card, since you borrow money at a fixed rate with a certain benefit day based on the term you pick. Keep in mind: When the honeymoon is over, the regular monthly payments will certainly be a suggestion of the cash you spent.

Personal Loans Canada Fundamentals Explained

Compare rate of interest prices, charges and lender online reputation prior to applying for the loan. Your debt score is a big aspect in establishing your qualification for the finance as well as the rate of interest rate.

Prior to using, know what your rating is so that you recognize what to anticipate in regards to costs. Watch for covert fees and fines by reviewing view website the lending institution's conditions web page so you do not finish up with much less money than you need for your monetary goals.

They're easier to certify for than home equity finances or various other safe lendings, you still require to reveal the lender you have the means to pay the finance back. Individual loans are much better than credit history cards if you want a set month-to-month settlement and require all of your funds at once.

The Definitive Guide to Personal Loans Canada

Credit history cards may also use rewards or cash-back choices that individual lendings don't.

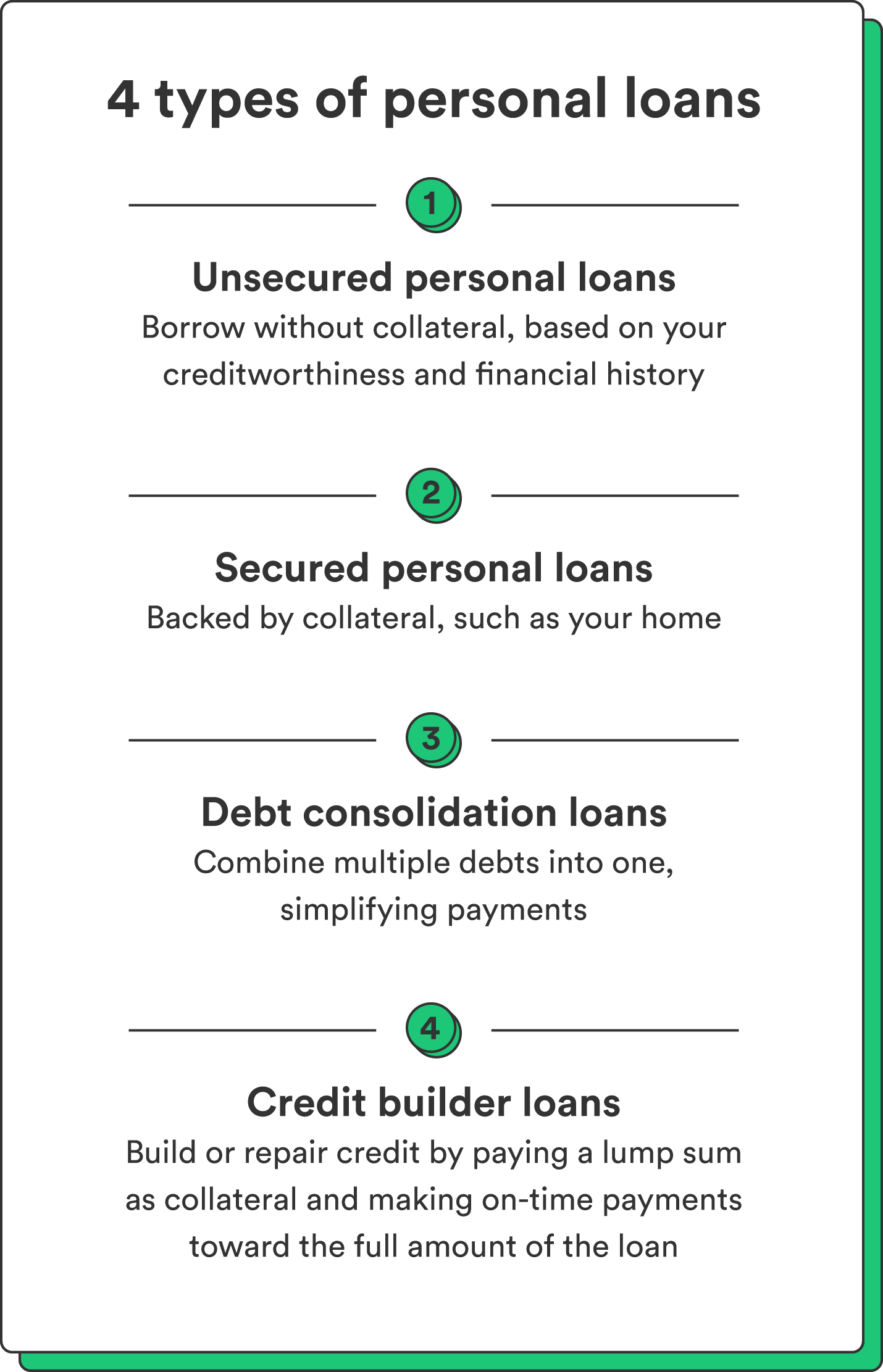

Some loan providers may likewise charge fees for individual lendings. Individual lendings are finances that can cover a number of personal costs. You can find individual car loans with financial institutions, credit score unions, and online lending institutions. Personal fundings can be secured, indicating you need security to borrow money, or unsecured, without collateral required.

, there's normally a set end date by which the finance will be paid off. An individual line of credit this score, on the other hand, might remain open and offered to you indefinitely as lengthy as your account continues to be in excellent standing with your loan provider.

The money obtained on the loan is not tired. If the lending institution forgives the finance, it is taken into consideration a terminated financial debt, and that amount can be strained. A protected individual financing requires some kind of security as a problem of borrowing.

Excitement About Personal Loans Canada

An her response unsafe individual lending requires no collateral to obtain money. Financial institutions, credit rating unions, and online lending institutions can offer both safeguarded and unprotected personal car loans to certified debtors. Financial institutions typically consider the last to be riskier than the previous since there's no security to accumulate. That can suggest paying a higher passion rate for an individual loan.

Once more, this can be a bank, credit scores union, or on the internet personal financing lending institution. If authorized, you'll be given the loan terms, which you can accept or decline.

Report this page